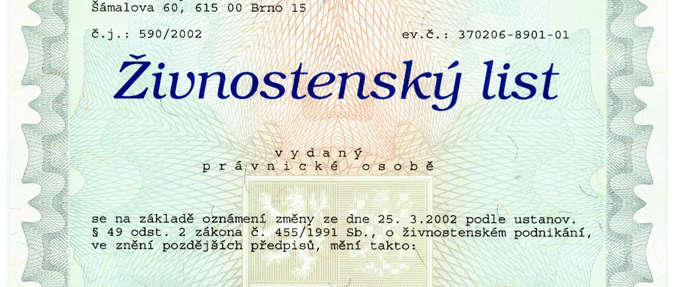

Czech Trade License (Živnostenský List) – A Complete Guide

Thinking of freelancing or starting your own business in the Czech Republic? You’ll likely need a Czech Trade License, commonly referred to as a Živnostenský list. This guide explains who needs one, the exact documents required, how much it costs (1,000 Kč), and how long it takes (around 7 days) if you have everything ready.

1. What Is a Czech Trade License (Živnostenský List)?

A Živnostenský list is a permit that allows you to legally operate as a self-employed individual or freelancer in the Czech Republic. Whether you’re providing services (IT, consulting) or running a small craft, you need this license to register and pay taxes properly.

- Unregulated Trades: The most common “free” trades (e.g., design, consulting). No special qualifications needed.

- Regulated Trades: Require proof of expertise, diplomas, or certifications (e.g., certain crafts, specialized professions).

Note: Having a trade license does not automatically grant you residency. If you need a visa or long-term stay to work legally, see our Czech Long-Term Visa Guide or Digital Nomad Visa article (placeholder links).

2. Eligibility & Requirements

To apply for a trade license, you typically need:

- Passport – Valid ID if you’re a foreign national.

- Criminal Record – May need an extract or certificate showing no serious offenses.

- Sídlo (Registered Address) – Proof of a physical or virtual office address in Czech Republic. This is mandatory for official communication.

- Age & Legal Capacity – Usually 18+ and no legal restrictions on conducting business.

- Proper Visa/Residency – Non-EU citizens must have the right to reside and work as self-employed. (Check our Long-Term Visa resources if you need a stay permit.)

Insurance Note: For certain trades or if you’re not an EU resident, you may need health insurance (and sometimes liability insurance) to cover potential risks. If you’re an EU resident, confirm if your national insurance is valid in Czech Republic. Non-EU residents often need a Czech health plan.

3. Steps to Obtain the Trade License

Step 1: Determine Your Trade (Unregulated vs. Regulated)

- Unregulated (Volná živnost): e.g., IT, marketing, design. No special credentials needed.

- Regulated / Craft (Řemeslná živnost): requires proof of qualification or experience.

For an official list of regulated vs. unregulated trades, see BusinessInfo.cz or the Ministry of Industry and Trade website.

Step 2: Gather Required Documents

- Passport – Must be valid.

- Criminal Record Extract – Possibly from your home country. Check if it needs a certified translation or apostille.

- Sídlo (Registered Address) – Proof of consent from the property owner, or a virtual office contract if allowed.

- Residency Permission (If Non-EU) – A valid visa or permit that allows self-employment.

Tip: If you’re unsure about translations or specific regulated trades, consult the BusinessInfo.cz guide for foreigners or seek professional assistance.

Step 3: Fill Out the Application at the Trade Licensing Office

- Submit your documents in person or sometimes online (if e-Government options are available in your region).

- Pay the 1,000 Kč administration fee (cash or card, depending on the office).

- Officers may ask about your chosen trade, address, and qualifications (if regulated).

Step 4: Processing (Approx. 7 Days)

If all documents are in order, the trade license is typically issued within 7 business days. You’ll receive an **Extract from the Trade Register** confirming your registration. Keep this document safe— you’ll need it for tax registration, bank accounts, etc.

4. Post-Registration Obligations

Tax Registration

- Register with the Financial Office for income tax.

- Depending on turnover, you might opt for a flat-rate tax scheme or standard tax regime.

Social & Health Insurance

- Sign up at your local Social Security Administration (OSSZ) and a Czech health insurance provider (VZP, etc.).

- Make monthly contributions. The exact amount depends on your declared income and whether you do “flat rate” or normal scheme.

Note: For specific steps on insurance and monthly cost estimates, see official guidelines at mzv.gov.cz or contact your insurance provider.

5. Common Pitfalls & Tips

- Wrong Address (Sídlo): If you can’t prove a valid Czech address, the application stalls.

- Criminal Record Translation: Some offices require a certified Czech translation. Double-check the requirement.

- Lack of Residency: A trade license alone doesn’t let you stay long-term—sort out your visa/residence permit first.

- Unpaid Social/Health: Failing to pay monthly contributions can lead to penalties.

6. FAQs: Czech Trade License (Živnostenský List)

- Do I need to speak Czech to get a trade license?

- Not necessarily. However, you may need a Czech-speaking assistant or translator for official forms and communication.

- Does a trade license allow me to live in Czech Republic?

- No. You still need the proper visa or residency status to legally stay in the country. The license only covers business activity.

- Is the 1,000 Kč fee a one-time cost?

- Yes, typically you pay 1,000 Kč when first registering. Changes (like adding new trades) may incur additional fees.

- Can I hold a trade license while employed?

- Yes, it’s possible. Many people have an Employee Card + a side freelancing license. Just ensure you meet tax/social obligations for both.

Need Assistance with Your Trade License?

Starting a business in a new country can be daunting. Our agency offers professional support for foreigners: from preparing documents and translations to handling the trade license application. We also guide you on taxes and insurance so you can focus on growing your business.