How to Open a Business in Czech Republic: Step-by-Step Guide for Expats

The Czech Republic is an attractive location for **foreign entrepreneurs** due to its **low corporate tax rates, EU market access, and stable business environment**. This guide explains how **expats can register a business in Czechia**, comparing the two main options:

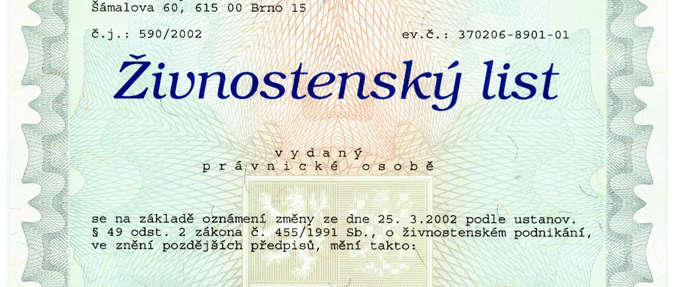

- Trade License (Živnostenský list) – Ideal for freelancers and sole traders.

- Limited Liability Company (SRO) – Best for larger businesses, hiring employees, and liability protection.

If you’re unsure which **business structure** is best, read our Trade License Guide or compare **tax requirements** in our Czech Taxation Guide.

1. Business Structures for Foreigners in Czechia

Option 1: Sole Proprietorship (Živnostenský List)

A **trade license (živnost)** allows expats to operate as **self-employed** individuals. It is the easiest way to start a **freelance or small business** in the Czech Republic.

- Registration Cost: 1,000 CZK (one-time fee).

- Taxation: Flat-rate tax available for freelancers.

- Best For: Freelancers, consultants, online businesses.

- Liability: Unlimited (personal assets are at risk).

For a detailed breakdown, read our Trade License Guide.

Option 2: Limited Liability Company (SRO)

An **SRO (Společnost s ručením omezeným)** is a **limited liability company** in the Czech Republic. It is ideal for **startups, small-to-medium businesses, and companies hiring employees**.

- Minimum Capital: 1 CZK (but 100,000 CZK is recommended for credibility).

- Corporate Tax Rate: 19%.

- Liability: Limited to company assets.

- Best For: Expats seeking to scale businesses or limit personal liability.

For tax obligations, visit the Czech Ministry of Finance.

2. Step-by-Step Guide to Registering a Business in Czech Republic

How to Register a Trade License (Živnostenský List)

A trade license (Živnostenský list) is the simplest way for expats to start a small business or freelance in Czechia. Follow these steps to register your trade license:

- Prepare Your Documents: – Valid passport – Proof of accommodation (lease agreement or notarized owner’s consent) – Business registration form (from the Trade Licensing Office)

- Visit the Trade Licensing Office (Živnostenský úřad): – Submit your documents – Pay the **1,000 CZK** registration fee

- Register for Taxes & Social Security: – Apply for a **tax ID** at the Czech Financial Office – Register for **health & social insurance** (if required)

- Receive Your Trade License: – Processing typically takes **5–7 days** – You will receive an **Extract from the Trade Register**

How to Register an SRO Company

An **SRO (Společnost s ručením omezeným)** is a limited liability company in the Czech Republic. Follow these steps to register an SRO company:

- Prepare Company Documents: – Draft **Articles of Association** – Obtain a **registered business address** – Appoint **managing directors**

- Sign Documents Before a Notary: – Have all founding documents notarized – Register with the **Czech Commercial Register**

- Open a Business Bank Account: – Deposit the **minimum share capital** (as low as 1 CZK but typically 100,000 CZK)

- Obtain Tax & VAT Registration: – Register for a **corporate tax ID** at the Czech Tax Office – If applicable, apply for **VAT registration**

- Receive Your Business Registration: – After processing (typically 10–15 days), you will receive your official company registration

3. Tax Obligations for New Businesses

- Corporate Tax: 19% for SROs.

- Personal Income Tax: 15%–23% for sole traders.

- VAT Registration: Mandatory if turnover exceeds **2 million CZK**.

For a detailed tax guide, visit our Czech Taxation Guide.

4. FAQs: Opening a Business in the Czech Republic

- Can a foreigner start a business in Czechia?

- Yes, non-EU expats can open a business with a residence permit and the correct trade license or company registration.

- What is the easiest way to start a business in Czechia?

- A trade license is the simplest option, requiring only a **1,000 CZK** registration fee.

- Do I need a Czech partner to open an SRO?

- No, foreigners can own **100% of an SRO** with no Czech partner required.

Need Help Registering Your Business in Czechia?

Starting a business as a foreigner in the Czech Republic can be complex. Our experts provide **legal, tax, and registration services** to make the process smooth.

Get Business Registration Help

What you’ve written here is not just a collection of ideas — it’s a conversation, one that spans across time and place. Your words evoke such a rich tapestry of images and emotions that it’s impossible not to be swept up in them. There’s an intimacy to the writing, a quiet understanding that connects the reader to something much larger than themselves.